Free Tax Preparation Appointments Open Soon!

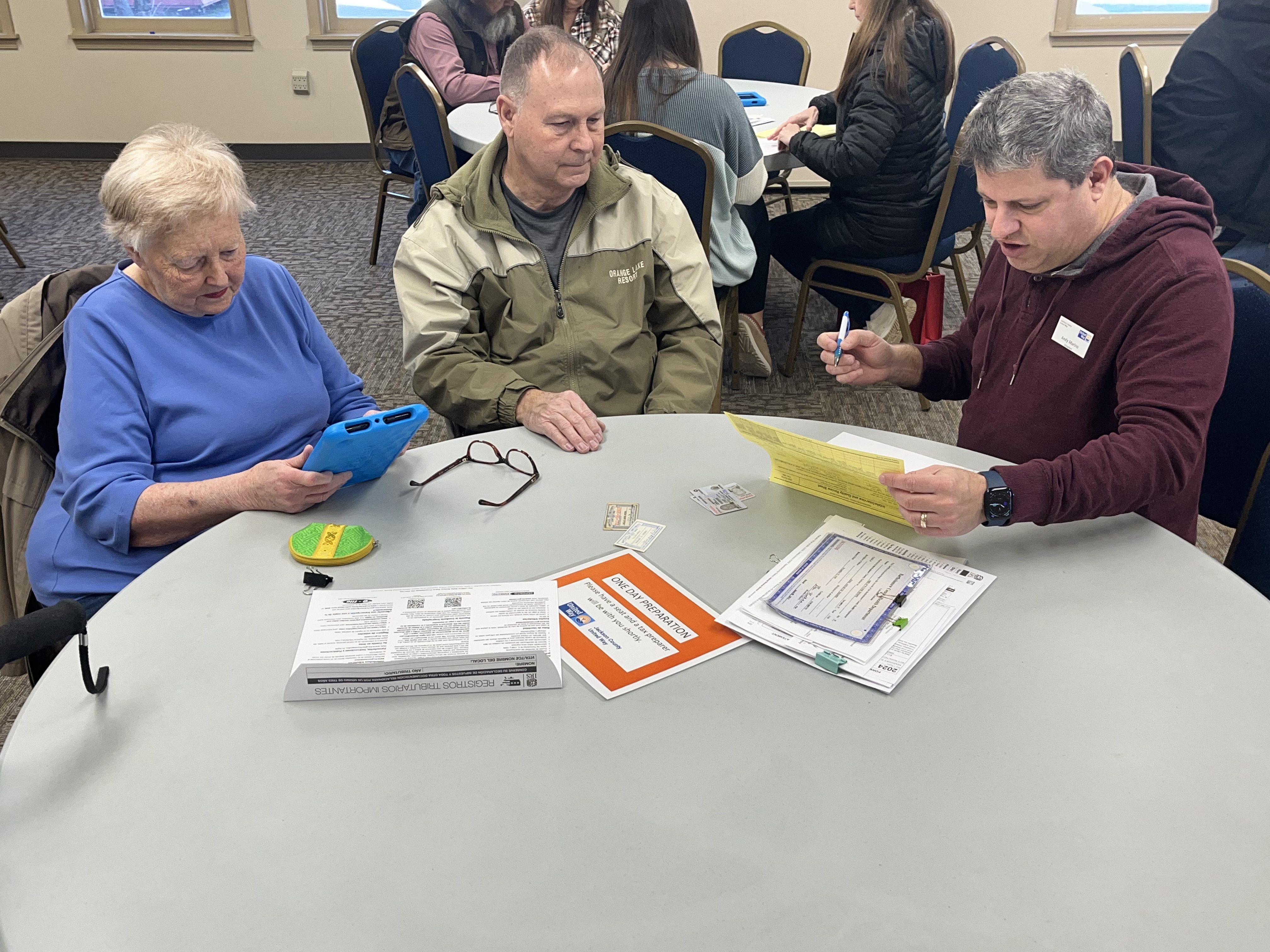

Jackson County United Way will begin scheduling tax preparation appointments during the third week of January 2026. This Volunteer Income Tax Assistance (VITA) program is available to households earning $66,000 or less and is made possible through the dedication of our incredible volunteers who generously share their time and expertise.

When appointments open, the fastest and most reliable way to secure your preferred date and time is to schedule online using the links that will be provided on this page. If you prefer to call, please leave a detailed message on the VITA voicemail—due to high call volumes, all messages will be returned within 24 business hours.

The VITA program proudly serves all of Jackson County, with convenient locations in Brownstown, Crothersville, Medora, and Seymour.

The Tax Filing Deadline is April 15, 2026

When come to your appointment, bring with you the following items if applicable:

For items marked with an asterisk "*" at the end - it is required

- What to Bring

• For married filing jointly, both spouses must be present with a valid ID *

• All Forms W-2 and 1099

• Information for other income

• Information for all deductions/credits

• A copy of last year’s tax return

• Proof of account for direct deposit of refund

• Social Security cards or Individual Taxpayer Identification notices/cards for you, your spouse, and/or dependents *

• Amount paid to day care provider and their tax ID number

• Birth dates for you, spouse and/or dependents on the return *

• Proof of foreign status if applying for ITIN

• Forms 1095-A, B or C (ACA Statements)

• For prior year returns, copies of income transcripts from IRS (and state, if applicable)

Still have questions? Call Jackson County United Way at 812-522-5450 ext. 1.